Don’t call me

This month we will share with you our experiences carrying out international projects in the Central and Eastern European region for B2B clients. We will discuss aspects which require particular focus during the project preparation phase and explain why is better not to call the respondents.

Research in the B2B sector is always a challenge for any research team. It is vital to understand the jargon of the industry being studied, to become familiar with its nuances, and to prepare thoroughly for conversations with professionals who take many things for granted.It becomes even more complicated when the research project needs to take account of not only the specifics of the industry it concerns, but also cultural and language differences.

Differences in company sizes

The ten largest Polish companies had turnover in 2013 ranging from € 3 to € 30 billion, while the top ten German companies recorded results between € 50 and € 200 billion – a very substantial difference. The smaller scale of companies operating in Eastern Europe is the first factor impacting B2B research in the region. Clients from Western Europe and North America are often under the impression that the structures of Eastern European markets are similar in development to their Western counterparts. It often turns out, however, that there are only a few companies in a given Eastern European country which fulfil those assumptions. Local markets are full of small companies which have only recently begun to consolidate into larger organizations. Their needs for advanced B2B services are in their infancy.

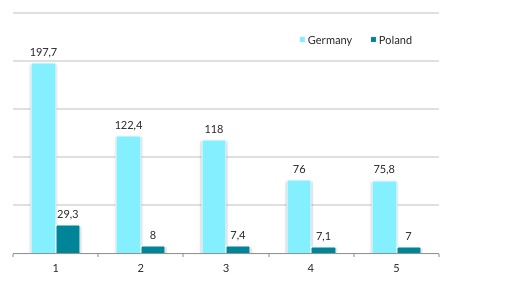

5 biggest companies in Germany and Poland according to their turnover in 2013 (bln EUR)

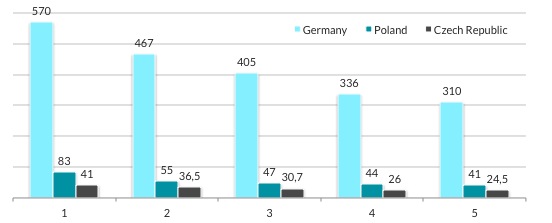

5 biggest companies in Germany, Poland and Czech Republic according to their number of employees (in thousand)

Different organizational structure

The Western European culture of work has developed over the past 200 years since the times of the industrial revolution. In that time, specific hierarchies, job titles and professions have formed. In Eastern Europe the history of company formation is slightly different – job titles did not originate from the needs of the market but rather due to political considerations by communist authorities.

In Eastern Europe, the introduction of the free market has been accompanied by the re-creation of the culture of work, a process which continues to the present day. Many positions found in Western European enterprises do not have counterparts in Eastern Europe companies. This creates particular difficulties when conducting an international research project as it is often assumed that interviews will be conducted with defined specialists. There are cases in which duties performed in a Western European organisation by one individual are distributed across several job titles in Eastern European companies. In this situation, the design of a research study must be adapted the specifics of the local market.

Different approaches to technology

Many aspects associated with modern technologies take on a different shape in Eastern European countries from Western European societies. While large enterprises are frequently very modern, infrastructure and public administration often do not keep up with the pace of change. European Union funds are a significant change driver, assisting new member states in modernizing infrastructure and systems used by businesses and public institutions. However it cannot be expected that direct video transmission will be available in every location or that respondents will have the capability of swiftly obtaining the required information.

Furthermore, in what may seem a paradox from the Western European perspective, smaller countries in the region are often more advanced technologically (and thus are richer). One example is of Estonia (with a population of just under 2 million), which is a world leader in Internet technologies.

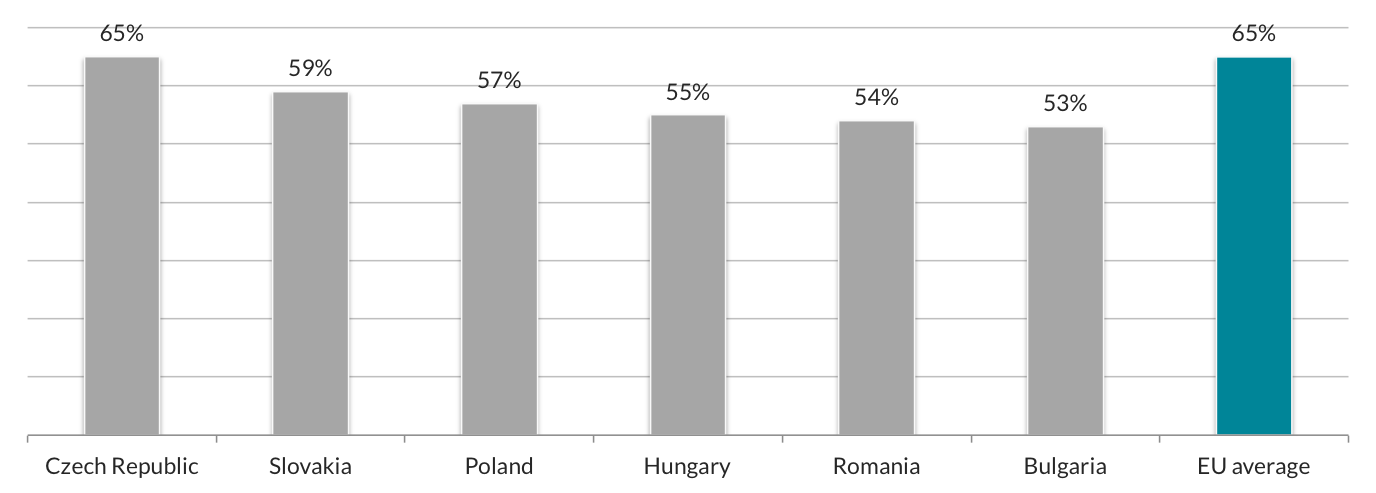

Households with Internet access across Eastern Europe

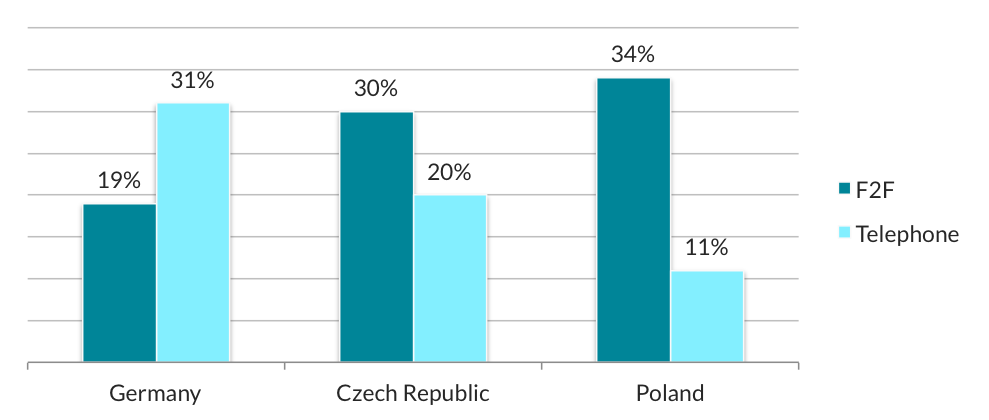

Spendings on quantitative research by method in 2014 (source: ESOMAR)

Another mentality

Apart from the different scales of businesses and their structures, factors linked directly to the culture of a given country play a significant role in the execution of B2B projects. While telephone interviews constitute the most frequently applied B2B sector research method in Western Europe, this is not always an optimal solution in Eastern Europe. Two factors influence the reluctance to provide information over the telephone, particularly information regarding a company’s finances. The first is a general distrust towards foreigners among Eastern Europeans. At Inquiry, the Hofstede model is often used as the basis for cross-cultural comparisons. It operates with five indices – one of them is the Uncertainty Avoidance Index, which is particularly high in Eastern European countries. This means that strict codes of behaviour are observed in Eastern European cultures and distrust towards outsiders is a social norm serving to help avoid novel, unfamiliar and uncertain situations.

The second factor is that B2B studies conducted using F2F interviews have a greater chance of success than telephone interviews. It is because of the general conviction in Eastern Europe that if someone wishes to obtain information, it is necessary to make the effort and visit the company in person. The exception to this rule is Russia, where the massive distances involved have led to telephone conversations being fully accepted as a means of conducting business. Eastern European respondents are particularly poorly disposed towards online surveys. This leads to increased costs for research projects associated with travel for interviewers and moderators however the value to clients of these unique insights received during direct interactions makes up for the additional expense.

At Inquiry we have over 10 years of experience in conducting B2B research in Eastern European markets. We are aware of the nuances of various industries and are happy to help you adjusting your project design according to the local specifics.